Fixed-Base Operator Market Size Predicted to Exceed USD 41.49 Billion by 2031, Rising at A CAGR of 7.6% | The Insight Partners

The report runs an in-depth analysis of market trends, key players, and future opportunities. The growing business aviation sector and fueling services contribute significantly to FBO service business are some of the major drivers of market growth.

/EIN News/ -- US & Canada, May 23, 2025 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, the global fixed-base operator market is observing healthy growth owing to the growing business aviation sector and the rise in demand for air travel across different regions.

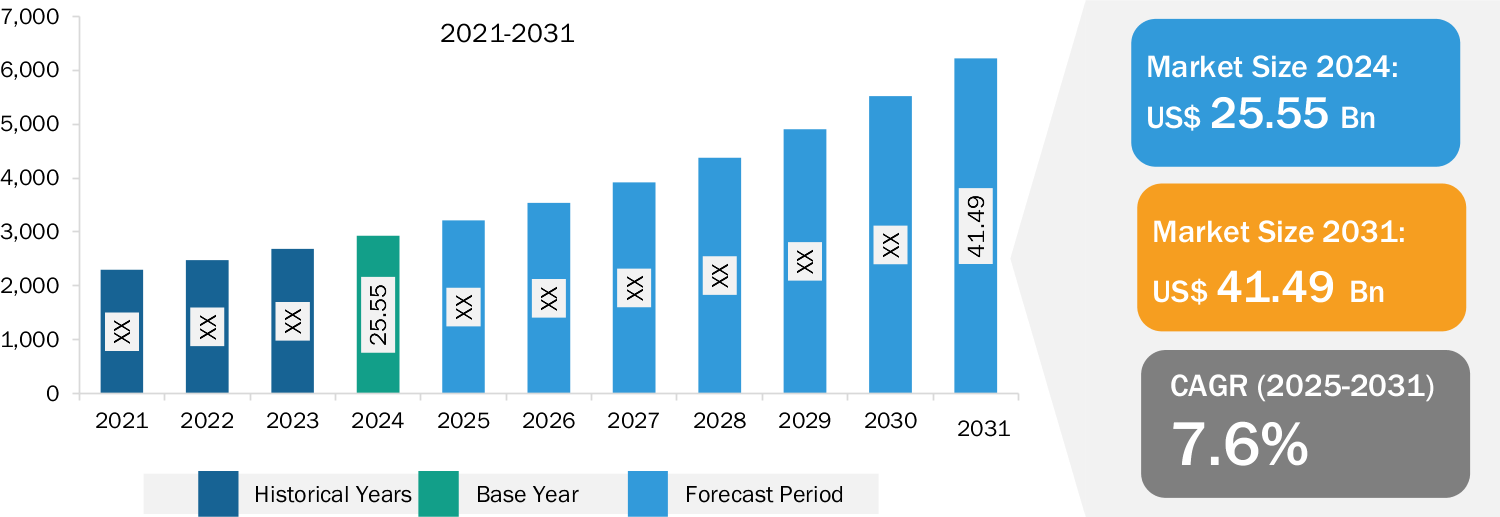

The global Fixed-Base Operator (FBO) market is projected to grow from approximately USD 25.55 billion in 2024 to around USD 41.49 billion by 2031, reflecting a CAGR of 7.6%. North America currently dominates the market, while the Asia-Pacific region is expected to witness the highest growth rate. With top key players Avemex SA De CV, Deer Jet, dnata Corporation, Jet Aviation (a subsidiary of General Dynamics Corporation), Jetex, Luxaviation, Signature Aviation, Swissport International AG, ExecuJet, Atlantic Aviation, Universal Aviation, and Abilene Aero Inc, among others.

To explore the valuable insights in the Fixed-Base Operator Market report, you can easily download a sample PDF of the report – https://www.theinsightpartners.com/sample/TIPRE00020706/

Overview of Report Findings

- Market Growth: The fixed-base operator market is expected to reach US$ 25.55 billion in 2024 and is expected to reach US$ 41.49 billion by 2031; it is estimated to record a CAGR of 7.6% from 2025 to 2031. The increase in business aviation and leisure aviation is supporting the demand for FBOs to offer various services to travelers and enhance their traveling experience. The ongoing decline in the global aviation market because of the pandemic has led many FBOs to reduce their costs and lay off workers. In order to sustain through the pandemic, the FBO service providers have implemented initiatives including business expansion and partnering with other FBOs or ground handling companies. Such initiatives facilitate market players to continue their business. The growth in the number of airports across different regions is adding up new flight routes worldwide, leading to an increase in demand for new FBO operators across the new airports. The construction of new Greenfield airports is expected to propel the demand for new FBO operators across different regions. Also, the ongoing construction of Cukurova Airport in Turkey (which was expected to be completed by 2023) is expected to generate new opportunities for FBO market vendors during the forecast period.

- Growth of Business Aviation Sector: The increasing number of individuals with ultrahigh net worth in developing regions is a one of the key factors boosting the business aviation sector globally. With large population and wealth in North America, Europe, and APAC region, the geographies are in a good position to quickly tackle flexibility issues to empower efficient business travel. Organizations such as ASEAN and APEC are synergistically working with the International Business Aviation Council (IBAC) and the Asian Business Aviation Association (AsBAA) for improving transportation regulations to implement efficient solutions. Business jet deliveries in China witnessed a decline due to poor domestic growth and poor business confidence in business jets. Despite the low demand for domestic business jets, various companies in China are confident of having new aircraft deliveries since the country is one of the main markets for the business jet in the region. The market is expected to grow globally as falling prices of pre-owned corporate aircraft make operating leases more attractive for buyers. The demand for business jets in other parts of the world is increasingly high due to mounting international trade and businesses, and surge in corporate travel activities, especially including managerial executives. As per the data published by the General Aviation Manufacturers Association (GAMA) in 2023, the business jet deliveries in 2023 increased by 730 from 712 in 2022. Further, the overall value of airplane deliveries in 2023 reached US$ 23.4 billion. Thus, the growth of the business aviation sector due to rising demand for business jets is bolstering the fixed-base operator market growth.

- High Potential for FBOs in APAC: The overall FBO market in APAC is witnessing slow growth as compared to other regions such as North America and Europe, which is mainly attributed to the presence of a smaller number of business as well as private jets across the region. The fixed-base operator market is observing decent growth in the Southeast countries such as Indonesia, Singapore, and Macau. Currently, there are total 71 FBOs operating in Asia Pacific countries; of these, more than 20 are operating in Australia, whereas mainland China has 15 FBOs. This number is anticipated to grow during the forecast period owing to growth in the overall aviation in the region. Such growth is leading to increased demand for fixed-base operators to provide various services. As per the data published by the Association of Asia Pacific Airlines in February 2025, the region has witnessed strong growth in the international air passenger and cargo market. Asia Pacific Airlines carried approximately 365.0 million international passengers in 2024, a 30.5% hike from 2023. In addition, as per the data published by Airbus in 2024, Asia Pacific is expected to add approximately 10,000 new aircraft between 2024 to 2043. Such increased airline traffic and growing demand for aircraft will directly affect the demand for FBOs positively during the forecast period, ultimately driving the FBO market in Asia Pacific.

- Geographical Insights: In 2024, North America led the market with a substantial revenue share, followed by Europe and Asia Pacific, respectively. Asia Pacific is expected to register the highest CAGR during the forecast period.

Market Segmentation

- Based on services offered, the fixed-base operator market is segmented into hangaring, fueling, flight instruction, aircraft maintenance, and aircraft rental. The fueling segment held the largest market share in 2024.

- By application, the market is segmented into business aviation and leisure aviation. The business aviation segment held a larger share of the market in 2024.

Get Updated Sample Pages on The Latest Fixed-Base Operator Market Report: https://www.theinsightpartners.com/sample/TIPRE00020706/

Competitive Strategy and Development

- Key Players: A few of the major companies operating in the fixed-base operator market are Avemex SA De CV, Deer Jet, dnata Corporation, Jet Aviation (a subsidiary of General Dynamics Corporation), Jetex, Luxaviation, Signature Aviation, Swissport International AG, ExecuJet, Atlantic Aviation, Universal Aviation, and Abilene Aero Inc, among others.

- Trending Topics: Premium FBO services market, Business aviation ground handling, Private jet terminal facilities, FBO market growth forecast, Aviation fuel supply chain, Luxury airport concierge services, General aviation infrastructure, Private aircraft handling standards, and FBO network expansion strategies etc.

Global Headlines on Fixed-Base Operator Market

- Jetex signed an agreement with Falcon Aviation to manage its FBO and hangar

- Atlantic Aviation acquired Ferrovial Vertiports from Ferrovial

- Jet Aviation, a part of General Dynamics Corp., acquired ExecuJet’s Zurich FBO and Hangar operations and Luxaviation’s Swiss Aircraft Management and Charter Divisions

Conclusion

The global fixed-base operator market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). North America accounts for the largest market share in 2024 and is projected to register a CAGR of 6.9% during the forecast period. The aviation sector in North America is experiencing significant expansion and development in response to the growing demand for air travel and the region's economic dynamism. Key airports, such as Hartsfield-Jackson Atlanta International Airport, Los Angeles International Airport, and Dallas/Fort Worth International Airport, are undergoing modernization to accommodate increased passenger traffic. The US has the largest number of airports in the world and a significant number of airport technology developers. The report by Airport Council International (ACI-NA) highlighted that North America's airport infrastructure requires US$ 151.1 billion to maintain or expand from 2023 to 2027. The key FBOs operating in the region include Paragon Aviation Group, Signature Aviation, Skyservice Business Aviation, Empire Aviation USA, others. The FBOs in the region offer diversified general aviation services such as storage, fueling, catering, concierge services, meeting rooms, and maintenance services. The region consists of maximum number of public use and private use airports with one or more than one FBOs present at the airports.

Purchase Premium Copy of Global Fixed-Base Operator Market Size and Growth Report (2021-2031) at: https://www.theinsightpartners.com/buy/TIPRE00020706/

Moreover, some of the recent developments across the North America FBO market include:

- In December 2024, Fontainebleau Aviation, a Skyservice Business Aviation company opened its 2nd private jet center in South Florida. This FBO sets new era for private aviation, redefining standards and expectations, and is expected to serve Florida’s top on-airport gateway for leisure and business travel.

- In addition, in January 2025, Empire Aviation USA opened aircraft on ground (AOG) facility at Skyservice’s premier fixed-base operator facility at Napa County Airport (APC), California. This has enhanced the company’s ability for delivering swift, reliable maintenance support to business and private aircraft fleet operators throughout California and the US.

Talk to Us Directly: https://tawk.to/chat/5d5a708ceb1a6b0be6083008/1i44d98rb

Trending Related Reports:

https://www.theinsightpartners.com/reports/aircraft-maintenance-tooling-market

https://www.theinsightpartners.com/reports/aircraft-floor-panel-market

https://www.theinsightpartners.com/reports/aircraft-brackets-market

https://www.theinsightpartners.com/reports/aircraft-wheels-market

https://www.theinsightpartners.com/reports/evtol-aircraft-market

https://www.theinsightpartners.com/reports/aircraft-video-surveillance-market

https://www.theinsightpartners.com/reports/commercial-aircraft-maintenance-tooling-market

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Home - https://www.theinsightpartners.com/

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release