ITS Logistics April Supply Chain Report: Uncertainties in Global Supply Chains Could Derail Freight Market Recovery in 2025

-- Shifting tariffs continue to drive volatility in cross-border and drayage operations --

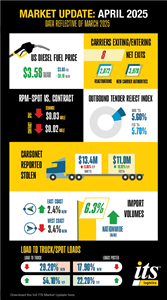

/EIN News/ -- RENO, Nev., April 23, 2025 (GLOBE NEWSWIRE) -- ITS Logistics released the April ITS Supply Chain Report. This month, the report confirms that tariff uncertainties continue to drive volatility in cross-border operations and drayage markets. Most major ports saw growth in import volumes through March as front-loaded inventory continued arriving in the U.S. Following the Trump Administration’s April 4 reciprocal tariffs announcement, however, global ocean container bookings dropped by 49%, priming the U.S. drayage market for a major cliff event. The flatbed market also contracted after two months of growth due to shrinking demand in the manufacturing sector. Warehousing continues to expand at a sluggish pace, with a notable month-over-month decline largely driven by pricing contractions in inventory, warehousing, and transportation sectors.

“The sudden announcement of tariffs has led to immediate disruptions,” said Josh Allen, Chief Commercial Officer at ITS Logistics. “We’re seeing a widespread booking freeze across international freight as businesses hit the brakes mid-shipment cycle. Companies are trimming down purchases and moving just enough to keep the lights on—and who can blame them? Nobody wants to move product today that could be twice as expensive to land next week. The result is a ‘big freeze’ that’s slowly working its way inland and will create significant volatility for everyone.”

Since January, the Trump Administration has announced and delayed multiple tariffs on imports from Canada and Mexico, causing even more volatility to the market as shippers try to move goods cross-border. According to the report, dry van spot market volumes from Toronto to Chicago increased by 57% during the week ending February 28, and rates in this cross-border lane rose by 7%, as shippers raced to move products ahead of tariffs. Spot rates from the U.S. to Canada have, on average, increased by 18% since the U.S. election and by 6% in the last two weeks of March to their highest level in two years. With the Trump Administration’s 25% blanket tariffs on Canadian imports now in place, cross-border shipping volumes could face a sharp decline that threatens both U.S. and Canadian carriers.

The key industries affected by current and evolving tariff measures include the automotive sector, agriculture and food exports, and metals and manufacturing. Ultimately, U.S.-based businesses in these industry sectors must understand the following dynamics as they continue to navigate the current market:

- Automotive Sector: Raw materials and components often cross the U.S.-Canada border — and incur tariffs — multiple times throughout the production process. As a result, vehicle costs are expected to increase by thousands of dollars, placing further downward pressure on consumer demand.

- Agriculture and Food Exports: China’s reciprocal tariffs on all U.S. imports, which increased to 125% as of April 12, threaten several U.S. agricultural exports, namely soybeans. China has already identified Brazil as an alternative supplier, and the shift away from U.S. markets could amplify long-term challenges faced by American farmers.

-

Metals and Manufacturing: Steel and aluminum tariffs are a significant concern, as they burden manufacturers who rely on raw materials and increase the prices of U.S. goods, making them less competitive globally. Analysts are concerned that the current tariffs risk raising costs for downstream industries that depend on these raw materials.

“Down-cycle markets are exhausting—for shippers, for carriers, for consumers,” continued Allen. “These tariffs are going to force some short-term chaos and push capacity out of the marketplace. Without movement, everyone stalls—shippers delay decisions, service providers struggle to survive, and the whole system drifts. But chaos forces companies to commit, plan, and compete.”

Understanding and adapting to these changes is crucial for U.S. businesses that rely on cross-border trade with Canada and Mexico. Moving forward into 2025, ITS Logistics suggests that businesses diversify supply chains, foster strong partnerships, focus on internal efficiencies, and monitor policy changes.

ITS Logistics offers a full suite of network transportation solutions across North America and distribution and fulfillment services to 95% of the U.S. population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, LTL, and outbound small parcel.

The monthly ITS Supply Chain Report serves to inform ITS employees, partners, and customers of marketplace changes and updates. The information in the report combines data provided through DAT and various industry sources with insights from the ITS team. Visit here for a comprehensive copy of the report with expected industry insights and market updates.

About ITS Logistics

ITS Logistics is one of North America's fastest-growing, asset-based modern 3PLs, providing solutions for the industry’s most complicated supply chain challenges. With a people-first culture committed to excellence, the company relentlessly strives to deliver unmatched value through best-in-class service, expertise, and innovation. The ITS Logistics portfolio features North America's #18 asset-lite freight brokerage, the #12 drayage and intermodal solution, an asset-based dedicated fleet, an innovative cloud-based technology ecosystem, and a nationwide distribution and fulfillment network.

Media Contact

Amber Good

LeadCoverage

amber@leadcoverage.com

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/30b6c49f-5e13-4418-8726-51fa23114908

Distribution channels: Science, Shipping, Storage & Logistics ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release